Why Choose Virtual Learning?

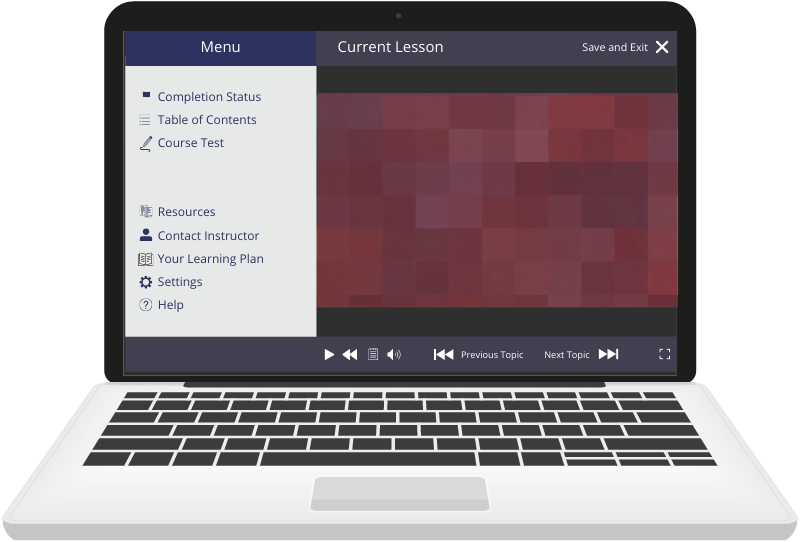

OUR ONLINE LEARNING MANAGEMENT SYSTEM

makes education accessible for all.

Earn Your Diploma from Home!

Available Programs

Programs marked with a ✓ include Certification Exam Prep.

Programs marked with a ✓ include Certification Exam Prep.

All programs are offered as Self-Paced.

Instructor-Led options are available for selected programs, indicated with a ✯.

Business & Leadership

Administrative Basic Skills

Administrative Office Assistant (QuickBooks)✓

Agile Certified Practitioner ✓

Become an Entrepreneur

Certified Associate in Project Management (CAPM) ✓

Certified Business Analysis Professional (CBAP) ✓

Customer Service Representative (CSR) ✓

Day Care Administration ✓

Event Planner

Management and Leadership

Professional in Human Resources (PHR) ✓

Project Management Professional (PMP) ✓

Sales and Marketing Basic Skills

Six Sigma Black Belt Certification ✓

Six Sigma Green Belt Certification ✓

Travel and Tourism Agent

Wedding Planner

Education

Finance & Accounting

Banking Management Operations

Bookkeeping (QuickBooks) ✓

Financial Planning and Wealth Management

Fundamentals of Accounting

Global Capital Markets

Intuit QuickBooks Online Plus ✓

Professional Tax Preparer Certification (DL) ✓

Retail Banking

Green & Renewable Energy

Certified Indoor Air Quality Manager (CIAQM) ✓

Certified Microbial Investigator (CMI) ✓

LEED Green Associate ✓

Healthcare & Allied Health

Administrative Dental Assistant ✓

Certified Electronic Health Records Specialist ✓

Dental Support Technician ✓

Medical Administrative Assistant Professional ✓

Medical Billing and Coding ✓

Patient Care Technician ✓

Personal Trainer (ACSM-CPT) ✓

Pharmacy Technician ✓

Phlebotomy Technician ✓

Physical Therapy Technician ✓

Veterinary Assistant

Industrial & Skilled Trades

Certified Maintenance and Reliability Technician ✓

HVACR Technician ✓

Landscaping Design and Business

Cybersecurity

Information Technology

Amazon Web Services (AWS) ✓

Artificial Intelligence ✓

Big Data and Microsoft Azure (DP-100, DP-203, & DP-900) ✓

Blockchain & Cryptocurrency

Business & Office Skills Curriculum ✓✯

Business Intelligence

CISCO Certifications ✓

Cloud Native Computing Foundation - Certified Kubernetes Administrator (CKA) ✓

CompTIA Networking Basics (A+, Network+, Cloud+, Server+, Linux+, Security+)✓

Computing Essentials (CompTIA A+, Data+, & CEHv11) ✓✯

Data Integration, Management, Warehousing, & Teradata

Data Science & Data Visualization (DP-100, PL-300) ✓

DevOps Engineer to Cloud Architect ✓

Google Cloud ✓

Java Programmer ✓

Machine Learning ✓

Microsoft Azure (7 Certifications) ✓

Microsoft Modern Desktop Administrator Associate ✓

Mobile Application Development

Oracle Database 12C (Oracle Certified Expert) ✓

Python Programmer ✓

Red Hat Certified System Administrator (RHCSA) ✓

Software Developer

Software Tester (ISTQB) ✓

TOGAF ✓

Legal & Criminal Justice

Multimedia & Graphic Design

AutoCAD Fundamentals Certificate ✓

Revit Architecture Certificate ✓

Web Development and Graphic Design ✓

Personal & Professional Development

Communication Skills at Work

Microsoft Office 365

Microsoft Publisher 2016

Office Collaboration Tools

Office Productivity Tools

Office Skills & Desktop Computing

Personal Career Development

Social Networking